U.S. President Donald Trump planned to propose on Wednesday steep cuts in corporate taxes and repatriated offshore corporate profits as the administration seeks to regain momentum on economic policies.

"We'll be having a big announcement on Wednesday having to do with tax reform. The process has begun long ago, but it really formally begins on Wednesday," the president said at the Treasury Department on Friday.

A senior Treasury staffer told CNBC that Treasury Secretary Steven Mnuchin and National Economic Director Gary Cohn are set to conduct a joint news conference around 1:30 p.m. ET on Wednesday from the White House Briefing Room.

Trump has told aides to cut the income tax rate for public companies to 15 percent from 35 percent, an administration official said, according to a Reuters report.

Another official said Trump would propose a repatriation tax on offshore earnings of 10 percent, compared with the current 35 percent, the report said.

That official also said the plan would cut the top tax rate on "pass-through" businesses, which include small business partnerships, sole

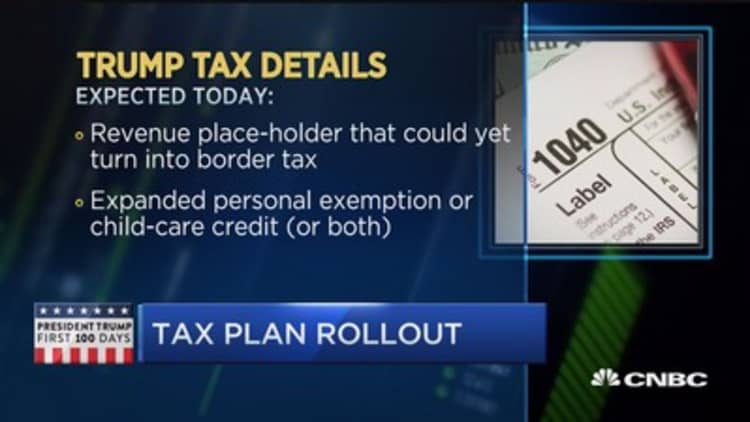

The plan wasn't expected to include a "border-adjustment" tax on imports, which had proved controversial, reports said.

It is not entirely clear how much the plan will differ from the proposal Trump outlined as a candidate, or the plan that House Speaker Paul Ryan has backed. Either way, Republicans — who control both chambers of Congress — will have to hammer out fine details if they want to pass the first major tax overhaul since 1986.

The White House originally set a goal to push through reform by a planned August recess for Congress, but Trump administration officials have more recently backed off that hard deadline.

As a candidate, Trump promised to slash income-tax rates across the board while lowering corporate taxes from 35 percent to 15 percent. He said at that time that his proposal would boost economic growth and help companies to create jobs.

Most analyses of that plan estimated it would make the U.S. deficit balloon because of the lost tax revenue. The Trump team has argued that economic growth unlocked by the plan will help to blunt the deficit expansion.

Trump has insisted

Ryan, for his part, has proposed a 20 percent corporate tax rate, coupled with a controversial method to raise revenue known as border adjustment. That has angered companies such as retailers that are primarily in the business of importing items made elsewhere and selling them in the United States.

Republicans plan to use the budget reconciliation process to pass a tax reform bill, meaning it would only need a majority of votes to pass. Nearly all Democrats will likely oppose a tax bill if it substantially chops tax rates for rich Americans and corporations.

—Reuters and CNBC's Lori Ann Larocco contributed to this report.